23+ j1 visa tax calculator

An au pair must be between. Web Our income tax calculator calculates your federal state and local taxes.

J 1 Visa Tax Return Information Documents And Application

Web The answer is yes J-1 visa holders can receive tax refunds just like their US.

. Web You must figure out your J-1 visa resident status to determine your J-1 visa tax status. She should start counting days on 01-01-2021 and should count these days as follows. Web Estimate how much youll owe in federal taxes for tax year 2022 using your income deductions and credits all in just a few steps with our tax calculator.

The tax percentage withheld. Web All right are reserved J1 Summer Tax Back Inc. First lets cover when you are considered a resident alien.

20 to file it. Web It depends how long you have been in the US. Web Just grab a calculator and knock it out in a few hours or less.

As a J-1 visa holder you are considered as a non-resident for the first two years since you entered the US. Ad Learn How Simple Filing Taxes Can Be. All you need is your W2 and whatever other documents apply to you.

Web Maya needs to determine whether she meets the Substantial Presence Test. Web Web The answer is yes J-1 visa holders can receive tax refunds just like their US. All J1 visa holders have to file Form 8843 Statement for Exempt Individuals and Individuals with a Medical Condition.

Web An au pair is always admitted into the United States on a J-1 visa and is not allowed to remain in the United States longer than one year. Web There are different J-1 visa tax rates depending on factors such as your income. In other words if you want the student.

It doesnt matter if you. Federal Income Tax withheld 14 16279. Federal Income Tax Rate Gross payment 116279.

Web OPT as well as individual students are taxed on their wages at graduated rates from 10 to 396 it depends on your income level. For foreign seasonal workers these three figures are zeroes. Ad Filing your taxes just became easier.

Web W 1000 1-14. Terms and conditions may vary and are subject. Start Today to File Your Return with HR Block.

You are a J-1 visa resident for tax. Web File Form 8843. TaxAct helps you maximize your deductions with easy to use tax filing software.

Whether you will receive a USA J-1 tax refund depends on the status. Web Make changes to your 2022 tax return online for up to 3 years after it has been filed and accepted by the IRS through 10312025. Life Has Enough Surprises.

Web These are usually 62 for Social Security up to 62 for Federal Unemployment and 145 for Medicare. Get Upfront Transparent Pricing with HR Block. File your taxes stress-free online with TaxAct.

Discover Helpful Information And Resources On Taxes From AARP. Then just mail it in. Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes.

All non-residents must pay 10 on any income tax up to 11000.

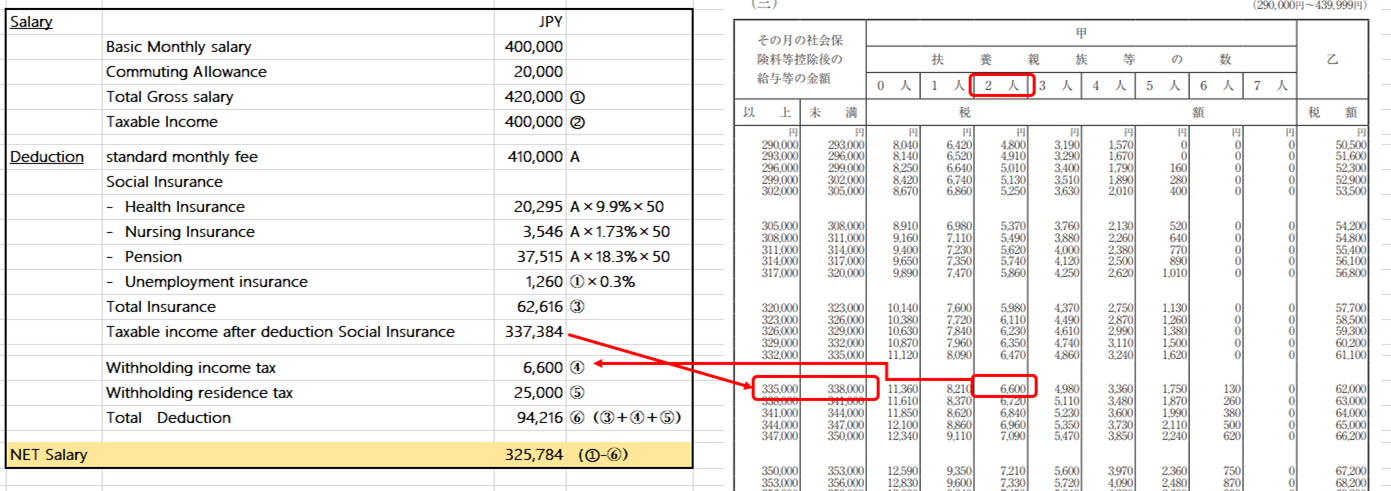

Payroll Services In Japan How To Calculate Monthly Payroll Withholding Income Tax Social Insurance Shimada Associates

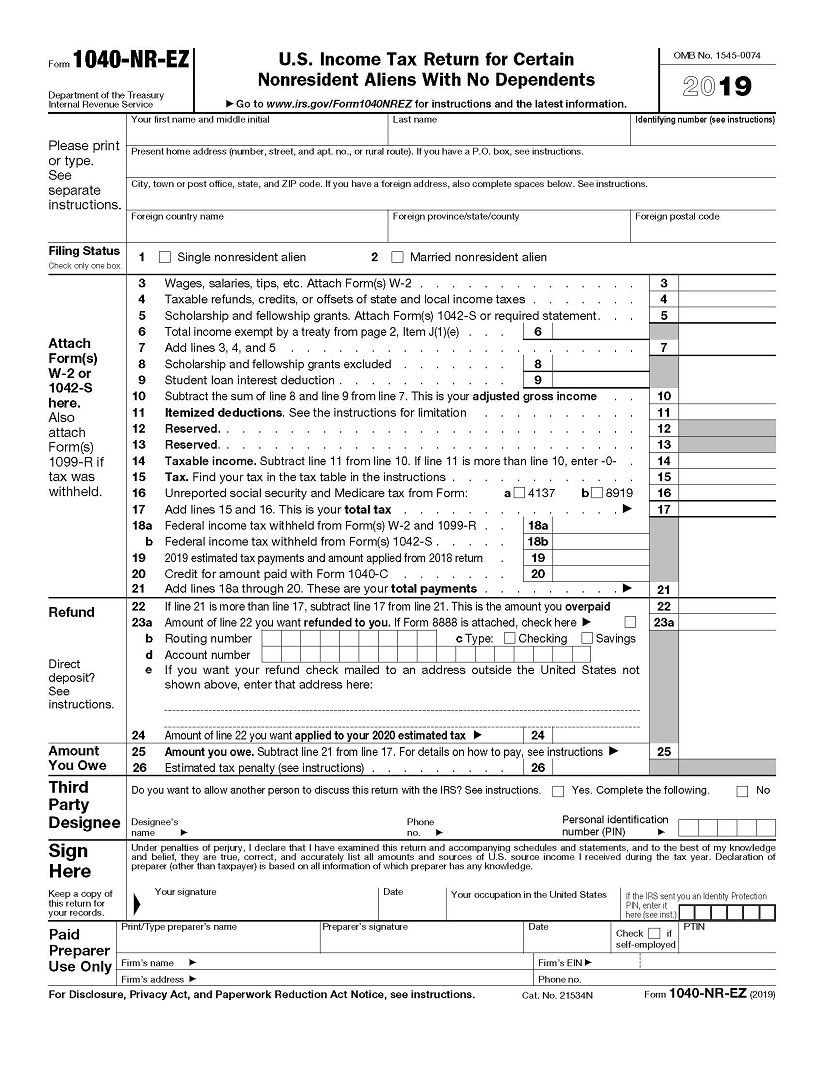

J1 Tax Refund In Usa Students Tax Returns Taxback Com

Us J1 Tax Refund Calculator Taxback Com Youtube

Research In The Community Vol 3 By Bay School Issuu

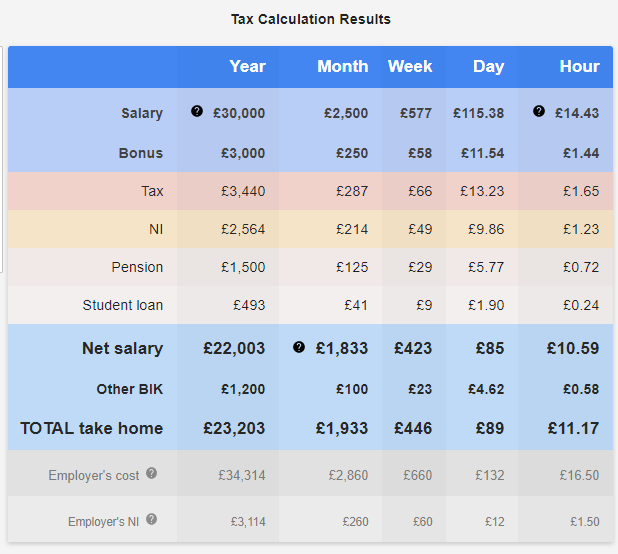

Tax Calculator Eca International

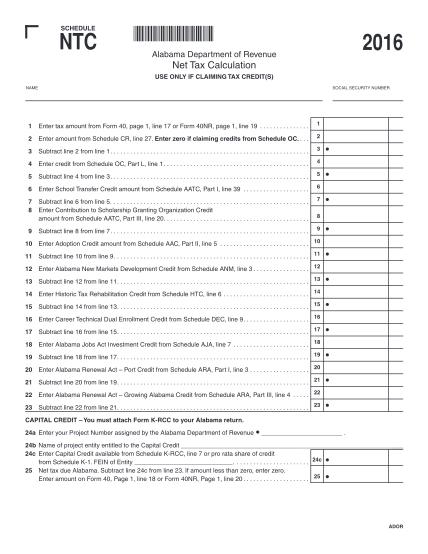

Setting Up Tax Information

The Complete J1 Student Guide To Tax In The Us

How To File A J 1 Visa Tax Return J1 Visa Taxes Explained 2023

What Is Fnd Pdf Internet Explorer Microsoft Excel

How To File A J 1 Visa Tax Return J1 Visa Taxes Explained 2023

The Complete J1 Student Guide To Tax In The Us

Galveston College 2017 2018 Catalog By Galveston College Issuu

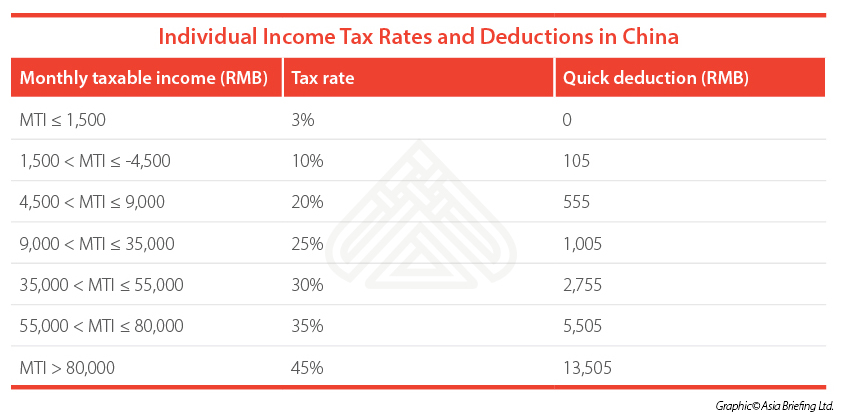

How To Calculate Foreigner S Income Tax In China China Admissions

18 Income Tax Refund Calculator Free To Edit Download Print Cocodoc

Paying Foreign Employees In China Individual Income Tax China Briefing News

![]()

Usa Tax Refund Calculator

Planning For A Great Financial Future The Savvy Scot